Make Epic Money Summary, Notes, and Quotes (Ankur Warikoo)

Make Epic Money is a beginner’s guide for a 20-year-old who doesn’t know a single thing about saving and investing. Ankur gives you all his wisdom on when to start investing, when to buy a home, how to use credit cards, and most importantly the relationship with money.

Yes, I have read the 330 pages of this book and yes, I have taken lots of notes while reading, so here I’m sharing with you all the notes along with key ideas from Ankur Warikoo’s book.

Disclosure: The quotes are from the book and everything else is the learning you will take from the book. As a writer myself, I respect authors. If any questions, kindly contact me at [email protected].

Let me first say thank you for reading this. This will be a weekly newsletter, hope you enjoy it. Now I will see you every Sunday at 9:00 AM (IST).

Make Epic Money Lessons

- When it comes to Investing, always play long-term games.

- Never ever rely on a single income stream, create multiple incomes.

- Create as much Asset as you can and lower the liability as you go along.

- Money won’t give you the happiness that you’re looking for but it will for sure give you the freedom to do the things you always wanted.

- Saving without any goals will make you lose your savings, so set goals.

- Make sure you have health insurance, life insurance, and emergency funds. So they can help you in your hard times.

- Don’t invest money, if you’re not able to fulfill your needs. First, earn money to fulfill your needs, and later when you have extra money, start your investment journey.

- Always better if you learn from other’s mistakes and don’t repeat the same. Life is too short to make mistakes that others have already made.

- Learn how people behave in certain situations, this will give you an idea about what people will do when they face any sort of discomfort in life.

- Before you invest your money, start by investing in yourself. Make yourself healthy, so you can do whatever you want.

Make Epic Money Summary

Make Epic Money is a Gen-Z guide to becoming financially independent. It’s a perfect read to understand what money is and how to use it wisely. As Ankur Warikoo says “Money won’t give you happiness but it will for sure give you the freedom to fulfill your dreams”

When I received the book, the first thought I had was, oh, this is a big book and this can’t be for new readers but when I read the first chapter then realized why this is only for new readers.

Because the author talks about how money was invented (from barter to piece of paper) and why we all humans agree on one single thing which is money.

The author also guides you on the best time to buy your dream house and when you should and shouldn’t take the debt. He even talks about when you should close your loans.

At the end of the book, Ankur talks about human behaviors like what Morgan Housel did in his The Psychology of Money and Same as Ever book.

Ankur Warikoo says “We make worse decisions at the end of the day. We make worse decisions when we’re tired.”

One more thing, smart authors know that people love free stuff and this is the reason Why Make Epic Money has more than 10 QR codes within the book that give you free MS Excel Budget, Tax Planning, or even an EMI planning calculator.

That being said, let’s explore each and every chapter but before that, if you want to take a look at the book I have on my bookshelf then click/tap here. I have added all the books I have and I will be adding new books whenever I make a purchase.

Why Money Matters

As the author says “In Money We Trust. And That’s Why it Works!”

The 1st chapter is all about how and why we all moved from a barter system to paper money.

Back in the day, we used to buy products by exchanging each other’s products.

For example, if I want 1 Egg and you said to me that, I have 1 Egg but I want an Apple in return, and I will say, take this apple and give me 1 Egg.

Read: Top 10 Best Personal Finance Books You Should Read Right Now

This exchange of items is called barter.

But the barter system didn’t last for a long time because all the products couldn’t have the same value.

So one day, a wise man comes in and says, hey, I want 3 eggs but I will give you 2 apples. So here, take this piece of paper that says, I have your egg and whenever you need your egg, bring this with you.

From that day, the idea of paper money came into place. This is why we all use paper money to buy things, this is the trust we all have because that note says “I promise to give this amount of money”.

The history of barter is quite long, so if you want to take a deep dive then I would suggest you visit the Wikipedia page of the barter system.

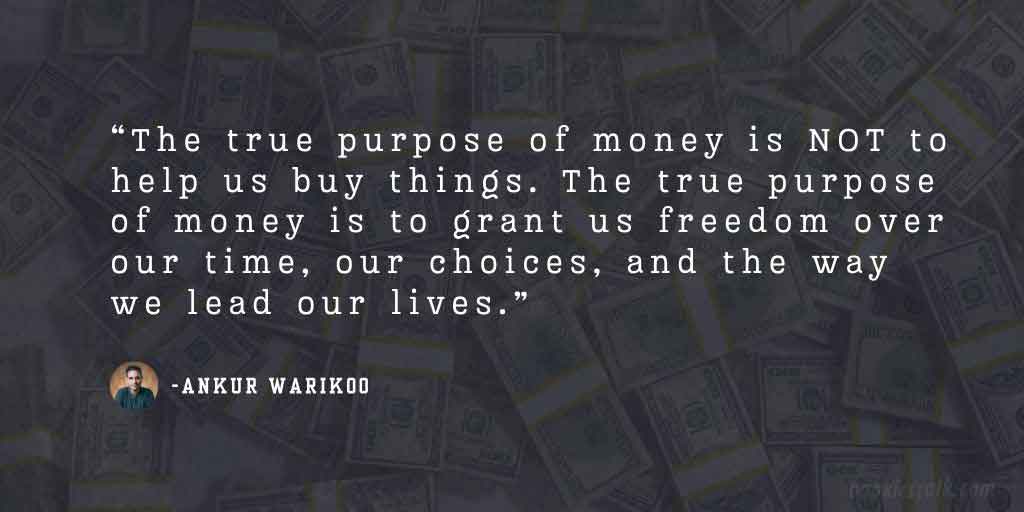

At the end of the chapter, the author says “The true purpose of money is NOT to help us buy things. The true purpose of money is to grant us freedom over our time, our choices, and the way we lead our lives.”

What he is trying to say is that money doesn’t buy you happiness but it gives you the freedom to do anything you want and the freedom might give you happiness.

Play Differently, Play Smarter

Ankur Warikoo says “Wealthy people have it figured out. They’re wealthy because they don’t build their lives around a salary. They use their time and ideas to create multiple income streams. They work for money. But they also put their money to work.”

The 2nd chapter is all about Asset and Liability. The author gives you a bunch of examples of what is Asset and Liability.

For example, a Car is a Liability because you will spend money on service, repair, and even insurance at the same time, investing and buying a house for rent is an Asset because your money is working for you.

So make sure you don’t spend your hard-earned money on Liability all the time, try to create an Asset that makes you money while you sleep.

“Even better, invest in yourself. Eat Well, Exercise, and learn new things every day. This will give you lots of new opportunities, so before you do anything, trust yourself and invest in yourself.” as the author says in the book.

There is no more powerful asset than yourself.

For those who are doing the job and want to create a new income stream, here, the author has added a list of things that you can do.

- Create Content: Whatever you love doing, you can start a blog or even a YouTube channel. One more thing, you won’t earn from day one but after some time, you will start seeing the results. Maybe start a website like BookiesTalk.com.

- Online Courses: Ankur Warikoo himself sells online courses and he makes crores every month. So first start a website & YouTube channel and after some time, provide value with the help of Courses.

- Invest in Stocks: If you’re earning money then it makes sense to invest. So pick a few stocks or maybe invest in an index fund. Play the long-term game and you will thank yourself.

These are not the only options to make money, there are tons of options available. Just pick one and start working on it.

Just take a few hours, maybe after the job or before you go to the job. A few hours every day for a year will do wonders.

So run after Assets and try to lower your Liability as you go.

Money You Don’t Have

Starting with the author’s words “It’s Not about Spending Less. It’s about Spending Right.”

The 3rd chapter is all about credit cards and Loans.

I love my credit card but I don’t use it to buy things that I don’t need. I’m not an impulsive buyer, once I was but now, I have learned from my mistakes.

The author says, if you have a credit card and if you want to buy a product worth Rs 60,000 then first check your bank account to see whether you have Rs 60,000 or not.

If the answer is, No I don’t have that amount of money then it is better you don’t use a credit card.

This is perfect, isn’t it? Don’t spend money that you don’t have, great advice. Now the problem is, we all know this, and yet we don’t apply this rule because we have EMIs.

Buy a Rs 60000 product on EMI, just pay 4000 every month, not a big deal at all.

This is the problem. Because of this mindset, you will keep buying everything on EMI whether you need it or not. I mean, you don’t need an iPhone, and yet you’re paying EMI.

So as the author says “Before you spend, Pause. Ask Yourself This. Does it make sense to ME? Treat your credit card like a cool debit card. Swipe it only when you’ve got the cash ready to go. Or when you’re sure you’ll have it next month.”

This also applies to taking a loan, buying a home, Car or even swiping a credit card.

The author also talks about how to pay EMIs but I won’t talk about this in-depth, instant I will leave you with the author’s words,

“If you give 1 extra EMI every year + increase your original EMI by 10% every year, you pay off a 25-year loan in just 10 years!”

Saving Won’t Make You Rich

The author says “If you’re just ‘saving’, it’s a random number. If you don’t hit it, you don’t care.”

The 4th chapter tells you everything about saving.

Let’s say, you’re saving Rs 5,000 every month but you don’t have any goals in mind then the day will come and you will end up spending it all.

Because of this, you will spend that savings whenever you need it, whether it’s on buying a new phone, going out with friends, or spending money where you don’t need it.

Related: 15 Must-Read Books in Life

The only thing you have to do is, set a goal.

Ask yourself, why are you saving that Rs 5,000 every month? It could be for buying a home, buying a new phone, buying a car, or for your retirement.

Setting goals will give you a clear idea and you won’t use that saving fund whenever you want because now, you know the reason for saving money.

The author also talks about the 50:30:20 Budget Rule.

- 50% of your salary on your needs (essential spending).

- 30% of your salary on your wants (desires, because, hey, you have a life!).

- 20% of your salary on your savings (and thus investments for your short-, medium, and long-term goals).

Saving is great but what’s even greater is investing. So do that as early as you can.

With that being said, Ankur Warikoo has shared a few tips to help you save more,

- 30-day Rule: Wait for 30 days if you’re about to make a big purchase. This will give you a clear idea of whether you need that product or not.

- Choose UPI/Debit Card over a Credit card: When you use UPI or even a Debit card, you’re spending the money you have whereas, when you use a credit card, you’re spending the money you don’t have. Use a Credit card when you have enough money in your bank account, if not, then don’t use it.

- Stick to The list: Going to the Mall to buy groceries is great but it’s even better if you go with a list of items you need, this way, you won’t end up buying the things you don’t need.

You will find more tips in the 4th chapter.

As always, ending the section with the author’s words “DON’T go through life focusing only on a savings mindset. There’s a limit to how much you can save. But remember, there’s no limit to how much you can earn.”

Protection Money

When you fly in an airplane, the air hostess says “Put your oxygen mask first”. In the same way, the author says “First and Always… Protect Yourself”

- Get health insurance to keep you steady amid surprise medical emergencies.

- Get life insurance for when the unimaginable occurs, disability, or accidents.

- Build an emergency fund for everything else.

You got it right, the 5th chapter is all about when to take health insurance, and life insurance and why & how much emergency fund you should save.

Have you read articles that tell you everything about which health insurance is good, when to take it, things to know before you buy health insurance, which company is the best, and why everyone should take health insurance?

The same author has written in this chapter, so it’s better if you use Google. So to save some time, let’s talk about the emergency fund.

The author also talks about emergency funds. Now, we won’t talk about it here because it’s too basic, so kindly read a few articles or watch the video Emergency Funds.

But before we move to the next section, here is what the author says about emergency funds.

“An emergency fund is like a DIY insurance plan. Cash is hidden away for the events that life and health insurance can’t cover. Car breakdowns, home fixes, sudden job jolts, legal surprises, travel emergencies. The unexpected stuff.”

Time To Earn While You Sleep

To put it into Ankur Warikoo’s words “Saving is great, but it’s pointless without investing. The biggest risk is taking no risk.”

Yes, the 6th chapter is all about investing and living a life full of freedom.

So invest as early as you can and as much as you can. It doesn’t matter whether you invest Rs 500 or even Rs 5,000.

Let’s say, you start investing Rs 500 at the age of 20, so by the time you are 60, you will have Rs 60 Lakhs.

This is the power of compounding. Also, it won’t be like, you will only invest Rs 500, you will invest more when you start earning more. What I’m saying is, increase your investment amount when your income grows.

“Allow compounding to happen. It takes time. Decades. For the longest time, it will seem like nothing is happening. But it IS happening!”

Now, the question you might have is, how much money to invest every month? Here use the 50:30:20 Rule.

- 50% For Your Needs

- 30% For Your Wants

- 20% For Your Investment

If you’re earning Rs 20,000 monthly then invest at least Rs 4000. Now, where to invest and how much, here, depends on how much risk you want to take.

If you’re a risky guy then you can invest Rs 4000 in the stock market but if you want a balanced portfolio then maybe invest

- Rs 1000 in PPF (gives you a fixed 7.1% interest annually)

- Rs 1000 in debt funds

- Rs 2000 in the stock market

This is called Asset Allocation. You can play around with numbers as per the risk you want to take.

Talking about myself, I invest 70% in the stock market and 30% in PPF. Along with this whenever I feel like it, I invest in crypto as well (not financial advice, it is too risky. I do it with no hope of getting money back)

The biggest takeaway that you will take from the 6th chapter is “Start investing as early as you can and invest for the long term”

Keep This in Mind

Everyone should not invest, there you go I said it. So if you’re earning Rs 10,000 monthly then it’s better you first fulfill your needs and focus on making more money.

But if you’re making Rs 30,000 monthly then it makes sense to invest because you can invest.

The 7th Chapter is all about if you’re earning X amount every year then how much to invest.

Now I won’t tell you everything but I will share three examples to give you a clear idea.

- Age 20: If your income is less than Rs 3 Lakh per Annum at the age of 20 then invest 30% of your income. Which could be 70% in mutual funds/stocks and 30% in fixed assets. Avoid taking loans and credit cards.

- Age 40: If your income is between Rs 3 to 9 Lakh per Annum at the age of 40 then invest 30% of your income. Which could be 60% in mutual funds/stocks and 40% in fixed assets. Avoid taking loans and credit cards.

- Age 30: If your income is above Rs 9 Lakh per Annum at the age of 30 then invest 30% of your income. Which could be 75% in mutual funds/stocks and 25% in fixed assets. Take advantage of credit cards and take loans as long as it’s for a home or car.

There you have it, there is nothing more to talk about in this chapter but in the end, I will leave with the author’s words.

“Your financial path is shaped by your age and your income.

Along with what you want in life and your responsibilities.

You have the cheat sheet, but you’re holding the cards.

Only YOU decide how to play them.”

Learn The Smart Way

Always better if you learn from other’s mistakes and don’t repeat the same. It’s also better to take risks early in life, this way, even if you make mistakes, you have enough time to recover.

As the author says “When you’re young, your ability to take risks is higher. Not because you’ve got it all figured out. Because you have time.Time to recover from any damage that may be caused by the risk.”

The 8th Chapter is all about mistakes.

This is a lengthy chapter and has 13 mistakes that you shouldn’t make. Now, I won’t add 13 mistakes here, for that, you will have to buy the book.

Lastly, let’s end this section with the author’s words “The fastest way to become wealthy is to go slow. The earlier you start, the better. The longer your money is invested, the better.”

Why We Do. What We Do

Do you know what is common in all of us, any guesses?

The answer is, wait for it, how we behave.

Morgan Housel puts this very well “Money has a little to do with how smart you are and a lot to do with how you behave. And behavior is hard to teach, even to really smart people.”

If we just observe how people behave in certain situations then we all will be smarter but we’re not because we’re emotional beings.

This topic has been discussed in lots of books, so I don’t want to waste your time discussing how our behavior influences our decisions. Still, if you’re curious then do read the Psychology of Money by Morgan Housel.

The Last Dance

The last and 10th chapter is all about the mistakes the author has made along with the things he would tell to his 20-year-old version.

He says “What you believe about money will influence everything. Without you even knowing it. It will drive your career choices.

It will have a say in your relationships. It will dictate your emotions. Your worries. It will impact your health.

Your relationship with money will shape your relationship with life.”

The last chapter has about 13 letters that the author would tell to his younger self. So to know all the letters, you have to buy the book.

In simple words, these letters are a kind of summary of the 9 chapters that we have discussed.

I don’t know about you but I love to read the last page of every book I read. So let me share with you the last paragraph of the Make Epic Money.

“Whenever you’re in doubt, bet on the only thing you can bet on.

Yourself.

Life will show you a way.

It’ll all be okay.

You will be okay.”

Make Epic Money Notes

The purpose of this section is to give you a place where you can revisit the book.

So let’s say, it’s been a year since you have read this book and now you want to know what that book was about, so you can come back here and recall everything.

For me, the biggest takeaway from the Make Epic Money was “Before you invest anywhere else, invest in yourself, there is no bigger asset than you”

That was one of the lessons, the Ankur Warikoo shared, along with that you will learn lots of other things in the Make Epic Money Book.

Again, what you’re about to read are notes I took from each chapter.

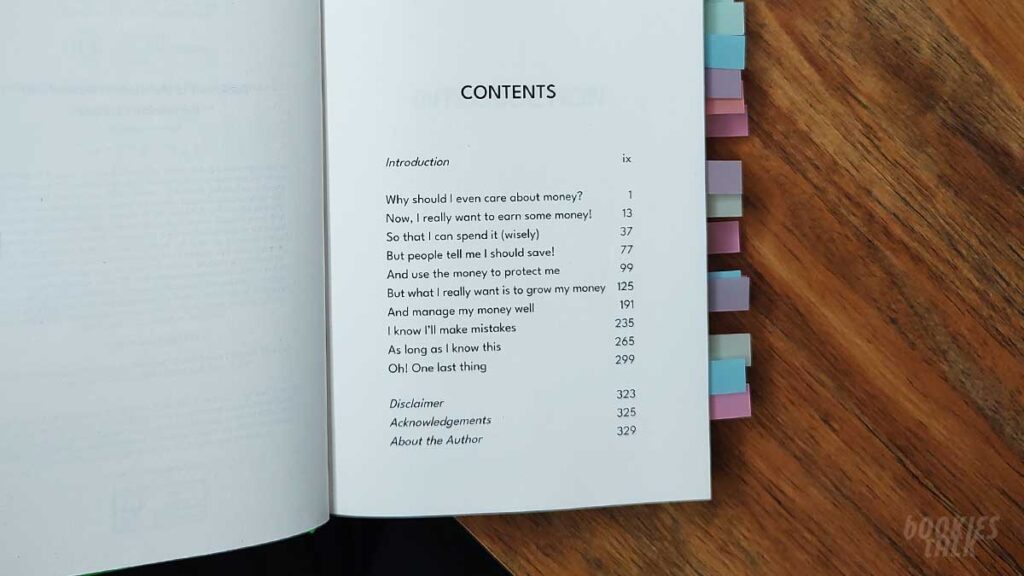

Chapter 1 Why should I even care about money?

- It’s mind-blowing. Money only works because we all believe in it. Money is the BEST example of trust in this world.

- The true purpose of money is NOT to help us buy things. The true purpose of money is to grant us freedom over our time, our choices, and the way we lead our lives.

- Total freedom to do whatever you want, whichever way you want, whenever you want. This is a life that we can build for ourselves. Once we understand how to stop working for money and, instead, make money work for us.

Chapter 2 Now, I really want to earn some money!

- The world sells you a dream. It tells you that once you start earning a salary, you can become wealthy.

- Wealthy people have it figured out. They’re wealthy because they don’t build their lives around a salary. They use their time and ideas to create multiple income streams. They work for money. But they also put their money to work.

- Professional degrees help you earn a living. Financial literacy helps you build wealth.

- Here is the only definition that matters: Does it earn you money? Yes? Then it’s an asset. No? Then it’s simply a possession. Maybe even a liability.

- Ultimately, the biggest asset you have is yourself. Your mind. Your body. Your education. Your well-being. Eat well. Exercise. Learn. They open doors to new opportunities. Invest in yourself.

Chapter 3 So that I can spend it (wisely)

- Spending money I didn’t have, and maintaining a lifestyle I couldn’t afford: that was the true failure.

- It’s Not about Spending Less. It’s about Spending Right.

- Before You Spend, Pause. Ask Yourself This. Does It Make Sense for ME?

- Before you let emotions in, let your rational side take over. Run the numbers first. Because emotions will eventually come in, irrespective of anything else.

- Treat your credit card like a cool debit card. Swipe it only when you’ve got the cash ready to go. Or when you’re sure you’ll have it next month.

Chapter 4 But people tell me I should save!

- If you don’t build the habit of saving while your salary is small, You’ll never be able to save when you begin to earn more.

- If you’re just ‘saving’, it’s a random number. If you don’t hit it, you don’t care.

- Savings = Needs minus Ego.Your needs: Rent, groceries, electricity, and other can’t-avoid-it essential bills. Enter your ego: The new iPhone that you want, the Starbucks coffee you must have every day to look cool, those cool sneakers, the high-end gym membership, etc. When you take out your ego expenses from what you’re left with after your needs, that’s savings.

- Don’t go through life focusing only on a savings mindset. There’s a limit to how much you can save. But remember, there’s no limit to how much you can earn. Keep finding ways to increase your income. That will help you build wealth much faster than saving.

Chapter 5 And use the money to protect me

- First and Always… Protect Yourself. Get health insurance to keep you steady amid surprise medical emergencies. Get life insurance for when the unimaginable occurs, disability, or accidents. Build an emergency fund for everything else.

- Health emergencies? Covered. Family protection? Covered. Now, an emergency fund? Seems a bit extra. An emergency fund is like a DIY insurance plan. Cash is hidden away for the events that life and health insurance can’t cover. Car breakdowns, home fixes, sudden job jolts, legal surprises, travel emergencies. The unexpected stuff.

- Pro Tips: Emergency fund first, investments later. Keep it bulletproof stock adventures, no crypto escapades, no gold or real estate experiments. Use the fund ONLY for real emergencies, not for impulsive buys. If you tap into your fund, refill it ASAP.

Chapter 6 But what I really want is to grow my money

- True financial independence comes: When income from your investments pays for your needs and expenses. For life! When you work because you want to, not because you have to. When you have money to live well, even without the 9-to-5 grind. That’s financial freedom.

- If you invested ₹500 a month in the stock exchange at the age of 20, by the time you are 60 you would have 60 lakh.

- Saving is great, but it’s pointless without investing. The biggest risk is taking no risk.

- Your 20s are actually the BEST time to start investing. Absolute prime time. Every good investor is about that edge. You don’t need to be the next Wolf of Wall Street. You don’t need super stock-picking powers or secret skills. Because you have the ultimate cheat code: TIME. That’s your VIP pass. Your greatest asset.

- Use the ‘Rule of 72’ to understand how long it’ll take to double your investment. The rule states: 72 / rate of return of your investment = approximate number of years taken to double your money

Chapter 7 And manage my money well

- Our Money Decisions Today Determine the Quality of Our Lives Tomorrow.

- Starting early is the way to go. But it’s never too late to start. Get intentional about your money. It’s your money story-YOU write it!

- In the End. Your financial path is shaped by your age and your income. Along with what you want in life and your responsibilities. You have the cheat sheet, but you’re holding the cards. Only YOU decide how to play them.

- Your Financial Plan Must Evolve with Each Life Stage

Chapter 8 I know I’ll make mistakes

- Circumvent the system by learning from your own mistakes. Beat the system by learning from the mistakes of others.

- Risk can’t be eliminated. It can only be understood and managed. When you’re young, your ability to take risks is higher. Not because you’ve got it all figured out. Because you have time. Time to recover from any damage that may be caused by the risk.

- ‘Live for today. You only live once!’ No, you don’t live only once. You live every day. And you are going to live for a long time.

- DO NOT spend money that you DO NOT HAVE!

- Financially smart people take loans, even if they can afford it, to save money. Financially weak people take loans, knowing that they can’t afford them, to spend money!

- The fastest way to become wealthy is to go slow.

Chapter 9 As long as I know this

- Numbers don’t drive money decisions. Our biases do. Our emotions do. And our emotions make us do some very stupid things.

- Choose logic over hype. Choose facts over fiction. Every single time.

- Investing with the herd is like following a GPS blindly-you might end up being stuck in traffic, but at least you’re not stuck alone!

- Ignoring problems doesn’t make them vanish. But we still think: ‘If I can’t see it, it doesn’t exist.’

- Avoid big money decisions when you’re hungry. Or lonely. Or tired. Nothing more to add here. You know what to do.

Chapter 10 Oh! One last thing

- What you believe about money will influence everything. Without your even knowing it. It will drive your career choices. It will have a say in your relationships. It will dictate your emotions. Your worries. It will impact your health. Your relationship with money will shape your relationship with life.

- Don’t forget that the only thing you actually wanted was happiness that’s the reason you were chasing money in the first place!

- Money is never more important than your relationships. Money is never more important than love.

- Whenever you’re in doubt, bet on the only thing you can bet on. Yourself. Life will show you a way. It’ll all be okay. You will be okay.

- No matter how hard things seem, there are always corners that will get you out. Just keep looking for those corners.

Make Epic Money Review

If your age is 15 and you have no idea about Investing, Saving, Emergency Funds, Fixed Assets, Health Insurance, Life Insurance, Credit Cards, and Even Home loans then Make Epic Money is the perfect read for you.

Now, comes the bigger BUT,

If you’re someone who knows what I have mentioned above then there is no need to read the book, you will for sure waste your money along with time.

This is what the author says in the introduction as well.

The Make Epic Money by Ankur Warikoo is a perfect guidebook for someone who is in high school.

The only thing I love about the book is the way the book has been formatted. It’s written in simple English, not a single hard word.

Whoever has formatted the book, congratulations you did a fantastic job. A perfect for the kid who doesn’t like to read books.

Buy Make Epic Money:

By the way, we also have a WhatsApp Channel, so if you love reading then it’s better to join the channel. And yes, it’s FREE…

Love What You Read, You Might Like These too…