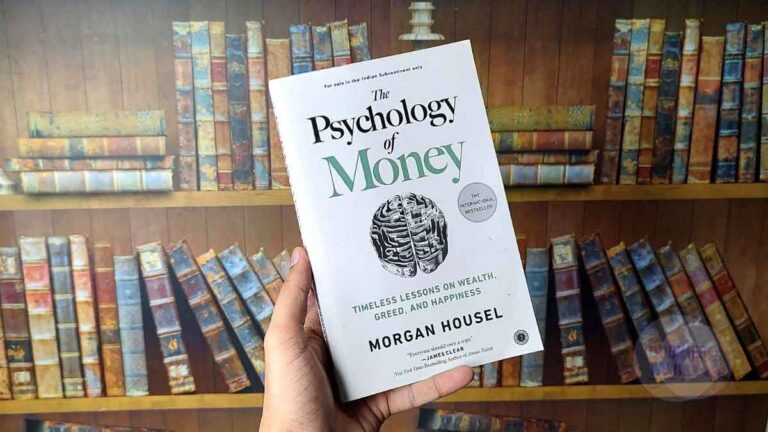

Chapter By Chapter Notes From The Psychology of Money

The book has 20 chapters and here, I’m about to share with you all the notes which I have taken when I was reading the book.

Morgan Housel has taught me lots of things from how to manage money and how to save money and much more, so I would highly recommend you grab a copy of this book because it will make a huge impact on your life.

Let me first say thank you for reading this. This will be a weekly newsletter, hope you enjoy it. Now I will see you every Sunday at 9:00 AM (IST).

The Psychology of Money Notes

Sometimes we want to buy a new smartphone, just because it has one or two new features and this can be called wants because you already have the smartphone and it’s working fine, and yet you want a new smartphone.

The funny thing is, you already know your needs and wants but you don’t want to accept them because doing exercise every day won’t make you happy but eating fast food will.

So I thought, let me share whatever I have bookmarked in the Psychology of Money Book, I have also arranged everything chapter by chapter for your convenience.

Chapter No 1: No One’s Crazy

- The person who grew up in poverty thinks about risk and reward in ways the child of a wealthy banker cannot fathom if he tried.

- The person who grew up when inflation was high experienced something the person who grew up with stable prices never had to.

- The stock broker who lost everything during the Great Depression experienced something the tech worker basking in the glory of the late 1990s can’t imagine.

- We all think we know how the world works. But we’ve all only experienced a tiny sliver of it.

- “Our findings suggest that individual investors’ willingness to bear risk depends on personal history.

- Local stock markets in Germany and Japan were wiped out during World War II. Entire regions were bombed out. At the end of the war German farms only produced enough food to provide the country’s citizens with 1,000 calories a day. Compare that to the U.S., where the stock market more than doubled from 1941 through the end of 1945, and it had been in almost two decades.

- Which is to say: Those buying $400 in lottery tickets are by and large the same people who say they couldn’t come up with $400 in an emergency.

- “To rephrase an old saying: everyone talks about retirement, but apparently very few do anything about it.”

Chapter No 2: Luck & Risk

- It’s possible to statistically measure whether some decisions were wise. But in the real world, day to day, we simply don’t. It’s too hard. We prefer simple stories, which are easy but often devilishly misleading.

- The cover of Forbes magazine does not celebrate poor investors who made good decisions but happened to experience the unfortunate side of risk.

- The dangerous part of this is that we’re all trying to learn about what works and what doesn’t with money. What investing strategies work? Which ones don’t? What business strategies work? Which ones don’t? How do you get rich? How do you avoid being poor? We tend to seek out these lessons by observing successes and failures and saying, “Do what she did, avoid what he did.”

- Failure can be a lousy teacher because it seduces smart people into thinking their decisions were terrible when sometimes they just reflect the unforgiving realities of risk.

- Nothing is as good or as bad as it seems

A little quick math.

- In 1968 there were roughly 303 million high-school-age people in the world, according to the UN.

- About 18 million of them lived in the United States.

- About 270,000 of them lived in Washington state.

- A little over 100,000 of them lived in the Seattle area.

- And only about 300 of them attended Lakeside School.

Start with 303 million, ending with 300. One in a million high-school-age students attended the high school that had the combination of cash and foresight to buy a computer. Bill Gates happened to be one of them. Gates is not shy about what this meant. “If there had been no Lakeside, there would have been no Microsoft,” he told the school’s graduating class in 2005.

Chapter No 3: Never Enough

- Warren Buffett later: To make money they didn’t have and didn’t need, they risked what they did have and did need. And that’s foolish. It is just plain foolish. If you risk something that is important to you for something that is unimportant to you, it just does not make any sense.

- There is no reason to risk what you have and need for what you don’t have and don’t need.

- If expectations rise with results there is no logic in striving for more because you’ll feel the same after putting in the extra effort.

- “The only way to win in a Las Vegas casino is to exit as soon as you enter.” That’s exactly how the game of trying to keep up with other people’s wealth works, too.

Chapter No 4: Confounding Compounding

- $81.5 billion of Warren Buffett’s $84.5 billion net worth came after his 65th birthday. Our minds are not built to handle such absurdities.

- Jim Simons, head of the hedge fund Renaissance Technologies, has compounded money at 66% annually since 1988. No one comes close to this record. As we just saw, Buffett has compounded at roughly 22% annually, a third as much.

- Simons’ net worth, as I write, is $21 billion. He is and I know how ridiculous this sounds given the numbers we’re dealing with-75% less rich than Buffett. Why the difference, if Simons is such a better investor? Because Simons did not find his investment stride until he was 50 years old. He’s had less than half as many years to compound as Buffett.

- There are books on economic cycles, trading strategies, and sector bets. But the most powerful and important book should be called Shut Up And Wait. It’s just one page with a long-term chart of economic growth.

Chapter No 5: Getting Wealth vs Staying Wealthy

- Getting money is one thing. Keeping it is another.

- We can spend years trying to figure out how Buffett achieved his investment returns: how he found the best companies, the cheapest stocks, and the best managers. That’s hard. Less hard but equally important is pointing out what he didn’t do. He didn’t get carried away with debt. He didn’t panic and sell during the 14 recessions he’s lived through.

- “It’d be great if the market returns 8% a year over the next 30 years, but if it only does 4% a year I’ll still be OK,” the more valuable your plan becomes.

Here’s how the U.S. economy performed over the last 170 years:

- 1.3 million Americans died while fighting nine major wars. Roughly 99.9% of all companies that were created went out of business.

- Four U.S. presidents were assassinated. 675,000 Americans died in a single year from a flu pandemic.

- 30 separate natural disasters killed at least each. 400 Americans

- 33 recessions lasted a cumulative 48 years.

- The number of forecasters who predicted any of those recession rounds to zero.

- The stock market fell more than 10% from a recent high of at

- least 102 times. Stocks lost a third of their value at least 12 times.

- Annual inflation exceeded 7% in 20 separate years.

- The words “economic pessimism” appeared in newspapers at least 29,000 times, according to Google.

Chapter No 6: Tails, You Win

- If a VC makes 50 investments they likely expect half of them to fail, 10 to do pretty well, and one or two to be bonanzas that drive 100% of the fund’s returns. Investment firm Correlation Ventures once crunched the numbers.20 Out of more than 21,000 venture financings from 2004 to 2014 65% lost money. Two and a half percent of investments are made 10x-20x. percent made more than a 20x return. One Half percent of about 100 companies out of 21,000 earned 50x or more. That’s where the majority of the industry’s returns come from.

- “The man who can do the average thing when all those around him are going crazy”

- A good definition of an investing genius is a man or woman who can do the average thing when all those around them are going crazy.

Chapter No 7: Freedom

- More than your salary. More than the size of your house. Mo than the prestige of your job. Control over doing what you want, when you want to, with the people you want to, is the broadest lifestyle variable that makes people happy

- When you accept how true that statement is, you realize that aligning money towards a life that lets you do what you want, when you want, with who you want, where you want, for as long as you want, has incredible returns.

- “Your kids don’t want your money (or what your money buys) anywhere near as much as they want you. Specifically, they want you with them,“

In his book Go Lessons for Living, gerontologist Karl Pillemer interviewed a thousand elderly Americans looking for the most important lessons they learned from decades of life experience. He wrote:

- No one-not a single person out of a thousand-said that to be happy you should try to work as hard as you can to make money to buy the things you want.

- No one-not a single person said it’s important to be at least as wealthy as the people around you, and if you have more than they do it’s a real success.

- No one-not a single person said you should choose your work based on your desired future earning power.

Chapter No 8: Man in the Car Paradox

- The letter I (Morgan Housel) wrote after my son was born said, “You might think you want an expensive car, a fancy watch, and a huge house. But I’m telling you, you don’t. What you want is respect and admiration from other people, and you think having expensive stuff will bring it. It almost never does-especially from the people you want to respect and admire you.”

Chapter No 9: Wealth is What You Don’t See

- Wealth is the nice cars not purchased. The diamonds were not bought. The watches were not worn, the clothes were forgone and the first-class upgrade declined. Wealth is financial assets that haven’t yet been converted into the stuff you sec.

- Singer Rihanna nearly went bankrupt after overspending and sued her financial advisor. The advisor responded: “Was it really necessary to tell her that if you spend money on things, you will end up with the things and not the money?

- Investor Bill Mann once wrote: “There is no faster way to feel rich than to spend lots of money on really nice things. But the way to be rich is to spend money you have and not spend money you don’t have. It’s really that simple.”

- Exercise is like being rich. You think, “I did the work and 1 now deserves to treat myself to a big meal.” Wealth is turning down that treat meal and actually burning net calories. It’s hard and requires self-control.

Chapter No 10: Save Money

- LET ET ME CONVINCE you save money. It won’t take long. But it’s an odd task, isn’t it? Do people need to be convinced to save money? My observation is that, yes, many do. Past a certain level of income people fall into three groups: Those who save, those who don’t think they can save, and those who don’t think they need to save. This is for the latter two.

- Learning to be happy with less money creates a gap between what you have and what you want similar to the gap you get from growing your paycheck but easier and more in your control.

- Savings without a spending goal gives you options and flexibility, the ability to wait, and the opportunity to pounce. It gives you time to think. It lets you change course on your own terms.

- Savings in the bank that earn o% interest might actually generate an extraordinary return if they give you the flexibility to take a job with a lower salary but more purpose, or wait for investment opportunities that come when those without flexibility turn desperate.

Chapter No 11: Reasonable Rational

- Most forecasts about where the economy and the stock market are heading next are terrible, but making forecasts is reasonable. It’s hard to wake up in the morning telling yourself you have no clue what the future holds, even if it’s true. Acting on investment forecasts is dangerous. But I get why people try to predict what will happen next year. It’s human nature. It’s reasonable.

- Invest in a promising company you don’t care about, and you might enjoy it when everything’s going well.

Chapter No 12: Surprise

- Things that have never before happens all the time.

- Experiencing specific events does not necessarily qualify you to know what will happen next.

- The problem is that we often use events like the Great Depression and World War II to guide our views of things like worst-case scenarios when thinking about future investment returns.

- “The four most dangerous words in investing are, it’s different this time.”

Chapter No 13: Room For Error

- The solution is simple: Use room for error when estimating your future returns. This is more art than science. For my own investments, which I’ll describe more in Chapter 20, I assume the future returns I’ll earn in my life will be lower than the historic average. So I save more than I would if I assumed the future will resemble the past. It’s my margin of safety. The future may be worse than lower than in the past, but no margin of safety offers a 100% guarantee.

- You can’t prepare for what you can’t envision.

Chapter No 14: You’ll Change

- “We don’t know what the future holds.” It’s another to admit that you, yourself, don’t know today what you will even want in the future.

- Tell a five-year-old boy he should be a lawyer instead of a tractor driver and he will disagree with every cell in his body.

Chapter No 15: Nothing’s Free

- “Every job looks easy when you’re not the one doing it.”

- But if you view volatility as a fee, things look different.

- Market returns are never free and never will be. They demand you pay a price, like any other product.

Chapter No 16: You And Me

- The common answer here is that people are greedy, and greed is an indelible feature of human nature.

- Bubbles aren’t so much about valuations rising. That’s just a symptom of something else: time horizons shrinking as more short-term traders enter the playing field.

- Sixty dollars a share was a reasonable price for the traders because they planned on selling the stock before the end of the day when its price would probably be higher.

Chapter No 18: When You’ll Believe Anything

- In 2007, we told a story about the stability of housing prices, the prudence of bankers, and the ability of financial markets to accurately price risk.

- In 2009 we stopped believing that story That’s the only thing that changed. But it made all the difference in the world.

- Once the narrative that home prices will keep rising broke, mortgage defaults rose, then banks lost money, then they reduced lending to other businesses, which led to layoffs, which led to less spending, which led to more layoffs, and on and on.

- The bigger the gap between what you want to be true and what you need to be true to have an acceptable outcome, the more you are protecting yourself from falling victim to an appealing financial fiction.

Conclusion

This is one of those books that everyone should read, even if you don’t like to read, go grab a copy of this book because it will teach you everything about money in a simple way.

BUY The Psychology of Money:

By the way, we also have a WhatsApp Channel, so if you love reading then it’s better to join the channel. And yes, it’s FREE…

Love What You Read, You Might Like These too…

Psychology class today