Make Epic Money by Ankur Warikoo

Make Epic Money is a beginner’s guide for 20-year-olds who know little to nothing about saving or investing. In this book, Ankur Warikoo shares his wisdom on when to start investing, when to buy a home, how to use credit cards effectively, and, most importantly, how to build a healthy relationship with money.

I’ve read all 330 pages of this book and taken notes along the way. Here, I’m sharing those notes with you, along with the key ideas from Ankur Warikoo’s book.

Disclosure: The quotes are from the book and everything else is the learning you will take from the book. As a writer myself, I respect authors. If any questions, kindly contact me at [email protected]

Enter your email address To join the newsletter. I will be with you every Sunday at 9:00 AM (IST). See you on Sundays.

Make Epic Money Lessons

- Diversify Your Income: Never rely on a single income stream. Build multiple sources of income.

- Focus on Assets: Create as many assets as possible and gradually reduce liabilities.

- Money and Freedom: While money may not bring ultimate happiness, it provides the freedom to pursue what truly matters to you.

- Set Goals for Savings: Saving without a purpose often leads to wasted money. Always save with clear goals in mind.

- Be Prepared: Ensure you have health insurance, life insurance, and an emergency fund to support you during tough times.

- Needs First, Investments Later: Don’t invest if you can’t meet your basic needs. Fulfill your necessities first, then use the extra funds for investments.

- Learn from Others: Avoid repeating the mistakes others have made—life is too short to learn everything the hard way.

- Understand Behavior: Study how people act in challenging situations. This insight will help you predict behaviors and adapt effectively.

- Invest in Yourself First: Prioritize your health and personal growth before investing financially. A healthy and capable you can achieve anything.

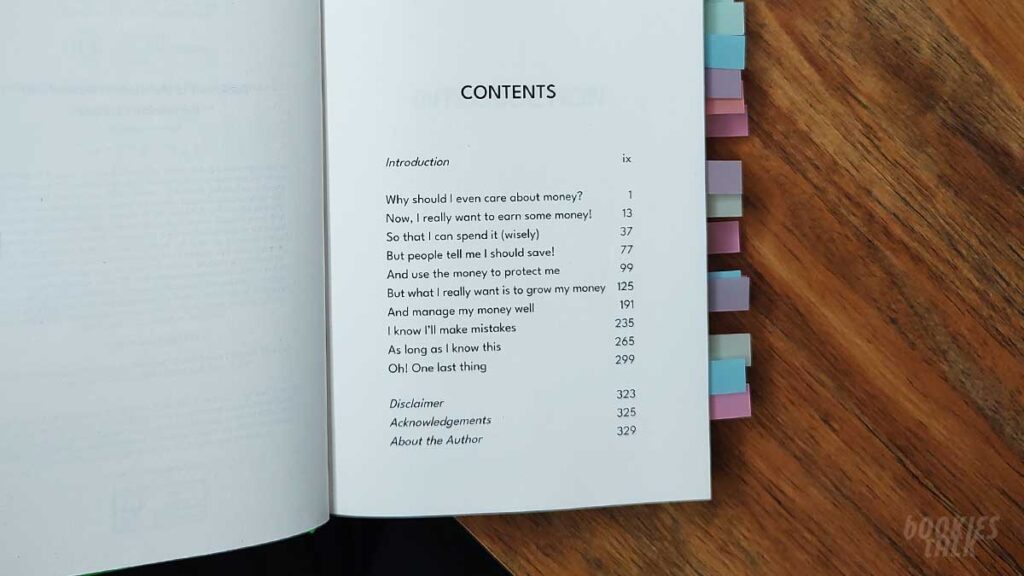

Make Epic Money Summary

Make Epic Money is a Gen-Z guide to becoming financially independent. It’s a perfect read to understand what money is and how to use it wisely. As Ankur Warikoo says “Money won’t give you happiness but it will for sure give you the freedom to fulfill your dreams”

When I first got the book, I thought it was too big for new readers. But after reading the first chapter, I realized it’s actually perfect for beginners. The author explains the history of money—from barter systems to paper currency—and why we all agree to use money.

Ankur also talks about the best time to buy your dream home and when you should or shouldn’t take on debt. He even gives advice on when to pay off loans.

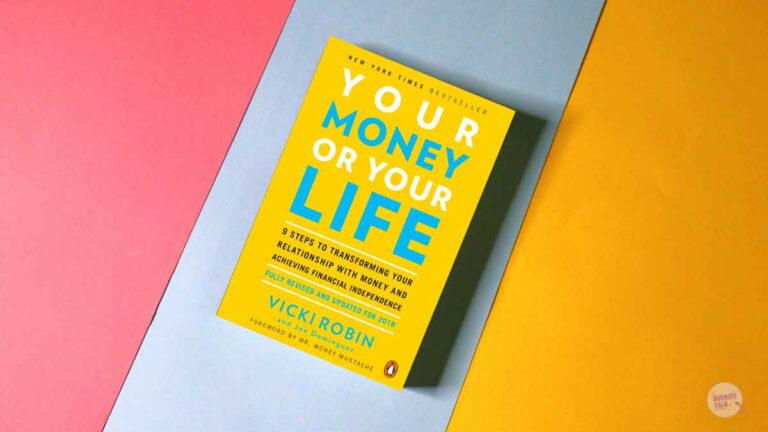

At the end of the book, Ankur explores human behavior, much like Morgan Housel did in The Psychology of Money and Same as Ever.

One of his key points is: “We make worse decisions at the end of the day. We make worse decisions when we’re tired.”

One more thing, smart authors know that people love free stuff and this is the reason Why Make Epic Money has more than 10 QR codes within the book that give you free MS Excel Budget, Tax Planning, or even an EMI planning calculator.

Now, let’s dive into the book chapter by chapter. But before that, if you want to check out the books I have on my bookshelf, click/tap here. I’ve listed all my books, and I’ll keep adding new ones whenever I make a purchase.

Why Money Matters

As the author says “In Money We Trust. And That’s Why it Works!”

The first chapter is all about how and why we all moved from a barter system to paper money.

In the past, we exchanged goods for other goods. For example, if I wanted an egg and you had one, but you wanted an apple in return, I would give you the apple and you would give me the egg.

Read: Top 10 Best Personal Finance Books You Should Read Right Now

This exchange of items is called barter.

However, the barter system didn’t last long because not all products had the same value.

So, one day, a wise man comes along and says, “I want 3 eggs, but I’ll give you 2 apples.” He then gives a piece of paper that says, “I have your egg, and whenever you need it, bring this with you.”

From that moment, the idea of paper money was born. This is why we all use paper money today—because it represents trust. The note says, “I promise to give you this amount of money.”

The history of barter is quite long, and if you want to dive deeper, I suggest checking out the Wikipedia page on the barter system.

At the end of the chapter, the author says, “The true purpose of money is NOT to help us buy things. The true purpose of money is to grant us freedom over our time, our choices, and the way we lead our lives.”

What he’s trying to say is that money doesn’t buy happiness, but it gives you the freedom to do anything you want, and that freedom might bring happiness.

Play Differently, Play Smarter

Ankur Warikoo says “Wealthy people have it figured out. They’re wealthy because they don’t build their lives around a salary. They use their time and ideas to create multiple income streams. They work for money. But they also put their money to work.”

The second chapter is all about understanding Assets and Liabilities.

For instance, a car is considered a liability because you will spend money on maintenance, repairs, and insurance. On the other hand, investing in a house for rent is an asset because it makes money for you.

This doesn’t mean you shouldn’t buy a car or a new phone. It simply means that you should first focus on fulfilling your needs. Once those are covered, then, if you wish, you can buy a few things that bring you happiness.

The key takeaway here is to avoid spending your hard-earned money on liabilities. Instead, try to create assets that generate income while you sleep.

As the author advises, “Even better, invest in yourself. Eat well, exercise, and learn new things every day. This will open up new opportunities for you. Before you do anything, trust yourself and invest in yourself.”

There’s no more powerful asset than you.

For those who are working a job and looking to create new income streams, the author suggests a few options:

- Create Content: Whatever you love doing, start a blog or YouTube channel. You won’t earn from day one, but after some time, you will start seeing results. Maybe start a website like BookiesTalk.com.

- Online Courses: Ankur Warikoo himself sells online courses and makes crores every month. Start a website or YouTube channel, and after some time, offer value through courses.

- Invest in Stocks: If you’re earning money, investing makes sense. Pick a few stocks or invest in an index fund. Play the long-term game, and you’ll be glad you did.

These are just a few ways to build income. There are tons of other options. Just pick one and start working on it.

Even if you can only dedicate a few hours every day, whether before or after your job, a year of consistent effort will pay off.

So, focus on building assets and reducing liabilities as you go.

Money You Don’t Have

Starting with the author’s words “It’s Not about Spending Less. It’s about Spending Right.”

The 3rd chapter is all about credit cards and loans.

I love my credit card, but I don’t use it to buy things I don’t need. I used to be an impulsive buyer, but I’ve learned from my mistakes.

The author advises that if you want to buy something worth Rs 60,000, first check your bank account to see if you have that amount. If you don’t, don’t use your credit card.

This is great advice, right? Don’t spend money you don’t have.

But the problem is, even though we know this, we don’t always apply it because now we have a new drug called “EMI”

It’s easy to justify buying a Rs 60,000 product on EMI with just Rs 4,000 a month. The issue is, this mindset makes us buy things we don’t really need, like an iPhone.

As the author says, “Before you spend, Pause. Ask Yourself This. Does it make sense to ME?” Treat your credit card like a debit card, and only swipe it when you have the cash, or when you’re sure you’ll have it next month.

This advice also applies to loans, whether for a home, car, or any other big purchase.

The author also talks about paying off EMIs, but here’s one key piece of advice:

“If you give 1 extra EMI every year + increase your original EMI by 10% every year, you pay off a 25-year loan in just 10 years!”

Saving Won’t Make You Rich

The author says “If you’re just ‘saving’, it’s a random number. If you don’t hit it, you don’t care.”

The 4th chapter talks all about saving.

Let’s say you’re saving Rs 5,000 every month, but you don’t have any specific goals in mind. Eventually, you’ll end up spending it all.

Without clear goals, you’ll use that savings whenever you need it—whether it’s on a new phone, going out with friends, or buying things you don’t really need.

Related: 15 Must-Read Books in Life

The key is to set a goal.

Ask yourself, why are you saving that Rs 5,000 every month? It could be for buying a home, a new phone, a car, or your retirement.

Setting a goal gives you a clear purpose, and it will prevent you from spending that savings unnecessarily because now you know exactly why you’re saving.

The author also talks about the 50:30:20 Budget Rule:

- 50% of your salary goes toward needs (essential spending).

- 30% of your salary goes toward wants (because, hey, you deserve to enjoy life!).

- 20% of your salary goes toward savings (and investments for your short-, medium-, and long-term goals).

Saving is great, but what’s even better is investing. Start investing as early as you can.

Ankur Warikoo shares a few tips to help you save more:

- 30-day Rule: Wait for 30 days before making a big purchase. This will help you determine whether you really need the product.

- Choose UPI/Debit Card over Credit Card: Using UPI or a debit card means you’re spending the money you already have, while credit cards make you spend money you don’t have. Use a credit card only if you have enough money in your bank account.

- Stick to The List: When you go to the mall to buy groceries, make a list. This will prevent you from buying things you don’t need.

You’ll find even more tips in the 4th chapter!

As always, ending the section with the author’s words “DON’T go through life focusing only on a savings mindset. There’s a limit to how much you can save. But remember, there’s no limit to how much you can earn.”

Protection Money

When you’re flying in an airplane, the air hostess says, “Put your oxygen mask first.” Similarly, the author advises, “First and always… Protect yourself.”

- Get health insurance to keep yourself secure in case of unexpected medical emergencies.

- Get life insurance to protect your loved ones in case of the unimaginable—disability, accidents, or worse.

- Build an emergency fund to handle any other surprises life throws at you.

The 5th chapter is all about knowing when to take health insurance, life insurance, and how much emergency fund you should save.

Have you read articles about the best health insurance, when to get it, what to consider, and which companies are the best? The author has shared similar advice here, so it might be quicker to check Google for more details.

Now, let’s focus on emergency funds. The author also talks about the same, but it’s pretty basic information, so I recommend reading a few articles or watching a video on Emergency Funds.

I feel the health insurance and emergency funds part could have been a bit smaller but it is what it is now.

Before we move on, here’s what the author says about emergency funds:

“An emergency fund is like a DIY insurance plan. Cash is hidden away for the events that life and health insurance can’t cover. Car breakdowns, home fixes, sudden job jolts, legal surprises, travel emergencies. The unexpected stuff.”

Time To Earn While You Sleep

To put it into Ankur Warikoo’s words, “Saving is great, but it’s pointless without investing. The biggest risk is taking no risk.”

Yes, the 6th chapter is all about investing and living a life full of freedom.

So invest as early as you can and as much as you can. It doesn’t matter whether you invest Rs 500 or even Rs 5,000.

Let’s say, you start investing Rs 500 at the age of 20, so by the time you are 60, you will have Rs 60 Lakhs.

This is the power of compounding. Also, it won’t be like you will only invest Rs 500; you will invest more when you start earning more. What I’m saying is, increase your investment amount when your income grows.

“Allow compounding to happen. It takes time. Decades. For the longest time, it will seem like nothing is happening. But it IS happening!”

Now, the question you might have is, how much money to invest every month? Here use the 50:30:20 Rule.

- 50% For Your Needs

- 30% For Your Wants

- 20% For Your Investment

If you’re earning Rs 20,000 monthly, then invest at least Rs 4,000. Now, where to invest and how much depends on how much risk you want to take.

If you’re a risky guy, you can invest Rs 4,000 in the stock market. But if you want a balanced portfolio, then maybe invest:

- Rs 1,000 in PPF (gives you a fixed 7.1% interest annually)

- Rs 1,000 in debt funds

- Rs 2,000 in the stock market

This is called Asset Allocation. You can play around with numbers based on the risk you want to take.

Talking about myself, I invest 70% in the stock market and 30% in PPF. Along with this, whenever I feel like it, I invest in crypto as well (not financial advice, it is too risky. I do it with no hope of getting money back).

The biggest takeaway that you will get from the 6th chapter is: “Start investing as early as you can and invest for the long term.”

Keep This in Mind

Everyone should not invest, there you go, I said it. So if you’re earning Rs 10,000 monthly, it’s better to first fulfill your needs and focus on making more money.

But if you’re making Rs 30,000 monthly, then it makes sense to invest because you can afford to.

The 7th chapter is all about how much to invest based on how much you’re earning each year.

Now, I won’t tell you everything, but I’ll share three examples to give you a clear idea.

- Age 20: If your income is less than Rs 3 Lakh per annum at the age of 20, invest 30% of your income. This could be 70% in mutual funds/stocks and 30% in fixed assets. Avoid taking loans and credit cards.

- Age 40: If your income is between Rs 3 to 9 Lakh per annum at the age of 40, invest 30% of your income. This could be 60% in mutual funds/stocks and 40% in fixed assets. Avoid taking loans and credit cards.

- Age 30: If your income is above Rs 9 Lakh per annum at the age of 30, invest 30% of your income. This could be 75% in mutual funds/stocks and 25% in fixed assets. Take advantage of credit cards and take loans as long as it’s for a home or car.

There you have it. There’s nothing more to talk about in this chapter, but in the end, I’ll leave you with the author’s words:

“Your financial path is shaped by your age and your income. Along with what you want in life and your responsibilities. You have the cheat sheet, but you’re holding the cards. Only YOU decide how to play them.”

Learn The Smart Way

It’s always better to learn from other’s mistakes and avoid repeating them. It’s also better to take risks early in life. That way, even if you make mistakes, you have enough time to recover.

As the author says, “When you’re young, your ability to take risks is higher. Not because you’ve got it all figured out. Because you have time. Time to recover from any damage that may be caused by the risk.”

The 8th chapter is all about mistakes.

This chapter is lengthy, and it covers 13 mistakes you shouldn’t make. Now, I won’t list all 13 mistakes here, for that, you’ll have to buy the book.

Lastly, let’s end this section with the author’s words: “The fastest way to become wealthy is to go slow. The earlier you start, the better. The longer your money is invested, the better.”

Why We Do. What We Do

Do you know what is common in all of us? Any guesses?

The answer is, wait for it, how we behave.

Morgan Housel puts this very well: “Money has a little to do with how smart you are and a lot to do with how you behave. And behavior is hard to teach, even to really smart people.”

If we just observe how people behave in certain situations, we would all be smarter. But we’re not because we’re emotional beings.

This topic has been discussed in many books, so I won’t spend time discussing how our behavior influences our decisions. But if you’re curious, do check out The Psychology of Money by Morgan Housel.

The Last Dance

The last and 10th chapter is all about the mistakes the author has made, along with the things he would tell his 20-year-old self.

He says, “What you believe about money will influence everything. Without you even knowing it. It will drive your career choices. It will have a say in your relationships. It will dictate your emotions. Your worries. It will impact your health. Your relationship with money will shape your relationship with life.”

The final chapter contains about 13 letters the author would write to his younger self.

In simple words, these letters are a kind of summary of the 9 chapters we’ve discussed.

I don’t know about you, but I love reading the last page of every book I read. So let me share with you the last paragraph of Make Epic Money:

“Whenever you’re in doubt, bet on the only thing you can bet on. Yourself. Life will show you a way. It’ll all be okay. You will be okay.”

Make Epic Money Notes

The purpose of this section is to give you a place where you can revisit the book.

So let’s say, it’s been a year since you read this book, and now you want to recall what it was all about. You can come back here and refresh your memory.

For me, the biggest takeaway from Make Epic Money was: “Before you invest anywhere else, invest in yourself. There is no bigger asset than you.”

That was one of the lessons Ankur Warikoo shared, and along with that, you’ll learn many other valuable insights from the book.

Again, what you’re about to read are notes I took from each chapter.

Chapter 1 Why should I even care about money?

- It’s mind-blowing. Money only works because we all believe in it. Money is the BEST example of trust in this world.

- The true purpose of money is NOT to help us buy things. The true purpose of money is to grant us freedom over our time, our choices, and the way we lead our lives.

- Total freedom to do whatever you want, whichever way you want, whenever you want. This is a life that we can build for ourselves. Once we understand how to stop working for money and, instead, make money work for us.

Chapter 2 Now, I really want to earn some money!

- The world sells you a dream. It tells you that once you start earning a salary, you can become wealthy.

- Wealthy people have it figured out. They’re wealthy because they don’t build their lives around a salary. They use their time and ideas to create multiple income streams. They work for money. But they also put their money to work.

- Professional degrees help you earn a living. Financial literacy helps you build wealth.

- Here is the only definition that matters: Does it earn you money? Yes? Then it’s an asset. No? Then it’s simply a possession. Maybe even a liability.

- Ultimately, the biggest asset you have is yourself. Your mind. Your body. Your education. Your well-being. Eat well. Exercise. Learn. They open doors to new opportunities. Invest in yourself.

Chapter 3 So that I can spend it (wisely)

- Spending money I didn’t have, and maintaining a lifestyle I couldn’t afford: that was the true failure.

- It’s Not about Spending Less. It’s about Spending Right.

- Before You Spend, Pause. Ask Yourself This. Does It Make Sense for ME?

- Before you let emotions in, let your rational side take over. Run the numbers first. Because emotions will eventually come in, irrespective of anything else.

- Treat your credit card like a cool debit card. Swipe it only when you’ve got the cash ready to go. Or when you’re sure you’ll have it next month.

Chapter 4 But people tell me I should save!

- If you don’t build the habit of saving while your salary is small, You’ll never be able to save when you begin to earn more.

- If you’re just ‘saving’, it’s a random number. If you don’t hit it, you don’t care.

- Savings = Needs minus Ego.Your needs: Rent, groceries, electricity, and other can’t-avoid-it essential bills. Enter your ego: The new iPhone that you want, the Starbucks coffee you must have every day to look cool, those cool sneakers, the high-end gym membership, etc. When you take out your ego expenses from what you’re left with after your needs, that’s savings.

- Don’t go through life focusing only on a savings mindset. There’s a limit to how much you can save. But remember, there’s no limit to how much you can earn. Keep finding ways to increase your income. That will help you build wealth much faster than saving.

Chapter 5 And use the money to protect me

- First and Always… Protect Yourself. Get health insurance to keep you steady amid surprise medical emergencies. Get life insurance for when the unimaginable occurs, disability, or accidents. Build an emergency fund for everything else.

- Health emergencies? Covered. Family protection? Covered. Now, an emergency fund? Seems a bit extra. An emergency fund is like a DIY insurance plan. Cash is hidden away for the events that life and health insurance can’t cover. Car breakdowns, home fixes, sudden job jolts, legal surprises, travel emergencies. The unexpected stuff.

- Pro Tips: Emergency fund first, investments later. Keep it bulletproof stock adventures, no crypto escapades, no gold or real estate experiments. Use the fund ONLY for real emergencies, not for impulsive buys. If you tap into your fund, refill it ASAP.

Chapter 6 But what I really want is to grow my money

- True financial independence comes: When income from your investments pays for your needs and expenses. For life! When you work because you want to, not because you have to. When you have money to live well, even without the 9-to-5 grind. That’s financial freedom.

- If you invested ₹500 a month in the stock exchange at the age of 20, by the time you are 60 you would have 60 lakh.

- Saving is great, but it’s pointless without investing. The biggest risk is taking no risk.

- Your 20s are actually the BEST time to start investing. Absolute prime time. Every good investor is about that edge. You don’t need to be the next Wolf of Wall Street. You don’t need super stock-picking powers or secret skills. Because you have the ultimate cheat code: TIME. That’s your VIP pass. Your greatest asset.

- Use the ‘Rule of 72’ to understand how long it’ll take to double your investment. The rule states: 72 / rate of return of your investment = approximate number of years taken to double your money

Chapter 7 And manage my money well

- Our Money Decisions Today Determine the Quality of Our Lives Tomorrow.

- Starting early is the way to go. But it’s never too late to start. Get intentional about your money. It’s your money story-YOU write it!

- In the End. Your financial path is shaped by your age and your income. Along with what you want in life and your responsibilities. You have the cheat sheet, but you’re holding the cards. Only YOU decide how to play them.

- Your Financial Plan Must Evolve with Each Life Stage

Chapter 8 I know I’ll make mistakes

- Circumvent the system by learning from your own mistakes. Beat the system by learning from the mistakes of others.

- Risk can’t be eliminated. It can only be understood and managed. When you’re young, your ability to take risks is higher. Not because you’ve got it all figured out. Because you have time. Time to recover from any damage that may be caused by the risk.

- ‘Live for today. You only live once!’ No, you don’t live only once. You live every day. And you are going to live for a long time.

- DO NOT spend money that you DO NOT HAVE!

- Financially smart people take loans, even if they can afford it, to save money. Financially weak people take loans, knowing that they can’t afford them, to spend money!

- The fastest way to become wealthy is to go slow.

Chapter 9 As long as I know this

- Numbers don’t drive money decisions. Our biases do. Our emotions do. And our emotions make us do some very stupid things.

- Choose logic over hype. Choose facts over fiction. Every single time.

- Investing with the herd is like following a GPS blindly-you might end up being stuck in traffic, but at least you’re not stuck alone!

- Ignoring problems doesn’t make them vanish. But we still think: ‘If I can’t see it, it doesn’t exist.’

- Avoid big money decisions when you’re hungry. Or lonely. Or tired. Nothing more to add here. You know what to do.

Chapter 10 Oh! One last thing

- What you believe about money will influence everything. Without your even knowing it. It will drive your career choices. It will have a say in your relationships. It will dictate your emotions. Your worries. It will impact your health. Your relationship with money will shape your relationship with life.

- Don’t forget that the only thing you actually wanted was happiness that’s the reason you were chasing money in the first place!

- Money is never more important than your relationships. Money is never more important than love.

- Whenever you’re in doubt, bet on the only thing you can bet on. Yourself. Life will show you a way. It’ll all be okay. You will be okay.

- No matter how hard things seem, there are always corners that will get you out. Just keep looking for those corners.

Make Epic Money Review

If you’re 15 and have no idea about investing, saving, emergency funds, fixed assets, health insurance, life insurance, credit cards, or even home loans, Make Epic Money is the perfect read for you.

Now, comes the bigger BUT.

If you’re someone who already knows about these topics, then there’s no need to read the book. You’ll likely waste both your time and money.

This is what the author mentions in the introduction as well.

What I really love about the book is its format. It’s written in simple English, without any hard words. Whoever formatted the book did a fantastic job. It’s perfect for a kid who doesn’t typically enjoy reading books.

Buy Make Epic Money:

Love What You Read, You Might Like These too…

By the way, we also have a WhatsApp Channel! If you love reading, this is the perfect place for you to join—and the best part? It’s completely FREE!